credit cards for people with bad credit

Getting a credit card when you have terrible credit isn’t clean. Most credit score card issuers anticipate you to have suitable credit score before they'll approve you for a credit card, but you could’t building up your credit score except you have got get right of entry to to a credit score card. Fortunately, there are a few credit score cards in the marketplace for purchasers with awful credit.

A few of the credit score playing cards on our satisfactory credit score cards for terrible credit score list are secured credit cards. These are a type of credit score card that lets in you to make a protection deposit against the credit score limit of the credit card. Your credit score restriction can be equal to the safety deposit. Because your protection deposit assumes a number of the risks, you’re much more likely to be authorised. As you pick the quality credit score card for you, don't forget your ability to pay a protection deposit, the once a year charge and other perks of the credit card.

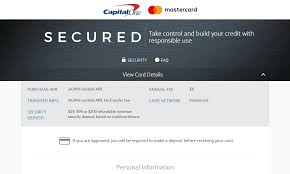

Capital One Secured

Courtesy of Capital One

The Capital One Secured MasterCard permits you to make a minimum safety deposit of $49, $99 or $2 hundred for a $two hundred credit score limit. Your credit records determines whether you qualify for one of the decrease protection deposit amounts. After you discover whether or not you’re approved, you could make a further protection deposit for a bigger credit score restriction before your account opens. You have to have a bank account so you will pay your security deposit.

After making your first five month-to-month payments on time, Capital One will do not forget you for an automated credit limit boom with out an extra security deposit. You’ll have also get right of entry to to CreditWise, a loose credit monitoring device that enables you stay on pinnacle of your credit rating.

Important Pricing: The APR is 24.Ninety nine percent, and there’s no annual rate.

Discover It Secured

Courtesy of Discover

Discover it Secured is the most effective secured credit card that allows cardholders to earn rewards on their purchases. Get percent coins lower back at restaurants or gasoline stations on as much as $1,000 in mixed purchases each quarter, plus one percent cash returned on all different credit card purchases. Discover will automatically fit all of the cash returned you’ve earned on the give up of the primary year. You can redeem your rewards at any time for any amount and mechanically at Amazon.Com.

Get loose get right of entry to in your FICO score to your monthly statements; plus, Discover monitors your Social Security range and signals you of fraudulent sports.

Important Pricing: The everyday APR is 24.Seventy four percentage APR, and there’s no annual charge.

Citi Secured Credit Card

Courtesy of Citi

Perhaps the best factor about the Citi Secured MasterCard is that it’s issued via Citi – one of the primary credit score card issuers. Good account control with your secured credit card may will let you qualify for certainly one of their better credit score cards.

With the Citi Secured MasterCard, you may make a safety deposit among $two hundred and $2,500 on the time you make an application. Your deposit is placed in a “Collateral Holding Account” for 18 months. Unfortunately, your deposit won’t earn hobby, and a financial ruin within the beyond 24 months can prevent you from being approved.

Important Pricing: The APR is 24.24 percentage, and there is no annual price.

First Progress

Courtesy of First Progress

The First Progress Select MasterCard Secured Credit Card doesn’t require you to have a credit score records or minimum credit score to be accepted. The card is issued by using Synovus Bank, Columbus, Georgia, that's a member of the FDIC and reviews to the 3 essential credit bureaus to help build your credit rating.

You ought to make a minimum security deposit of $200 to be authorized. The annual fee of $39 is classed in your credit card from the date your account is opened. That manner if you make an initial protection deposit of $2 hundred, your starting to be had credit will be $171.

Your protection deposit is held in a non-hobby bearing account. To receive a reimbursement to your safety deposit, you’ll should pay your stability in complete, near your account and ship lower back your credit card reduce in 1/2.

Important Pricing: The Purchase APR is 14.24 percentage APR, and the once a year rate is $39.

Open Sky

Courtesy of Open Sky

The OpenSky Secured Visa lets in you to make a safety deposit between $two hundred and $3,000 to comfortable your credit restrict. You pays your protection deposit with a Visa or MasterCard debit card, that's a plus due to the fact many secured credit score card issuers require you to apply a bank account.

You can request to boom your credit limit after your account is opened. If your request is accredited, OpenSky will will let you make an extra deposit for the credit score limit growth and might fee a further charge. You gained’t earn any hobby to your security deposit.

Unfortunately, you gained’t have the choice of changing this card to an unsecured credit score card. Your deposit will simplest be again to you inside four to six weeks of closing your account.

Important Pricing: The APR is nineteen.14 percentage. The annual rate is $35.

Wells Fargo

Courtesy of Wells Fargo

If you have got get entry to to capital and need a credit score card with a high credit restriction for your credit records, don't forget the Wells Fargo Secured Visa. You could make a protection deposit in $a hundred increments from $three hundred all the way as much as $10,000.

Your protection deposit is positioned in a non-interest bearing account until your credit card is closed or upgraded to an unsecured credit card. There’s no preset time to your account to be upgraded. Whether you’re upgraded in any respect relies upon on the way you manage your Wells Fargo Secured Visa and another money owed on your credit score record.

Important Pricing: It has a 20.74 percent APR. There's $25 annual rate.

American Express

Courtesy of American Express

The USAA Secured American Express locations your security deposit right into a USAA Bank two-year Certificate of Deposit (CD), which earns interest. You must make a minimum $250 protection deposit to get commenced, and you may make extra deposits in your CD at any time and request a credit restrict boom to in shape. You’ll preserve your deposit plus any interest earned on it as long as you don’t default on your payments.

This credit score card is simplest available to USAA contributors: lively or retired members of the military and their family. Military contributors experience unique deployment hobby rates beneath the Servicemembers Civil Relief Act.

While there’s no penalty charge if you’re overdue on payments, you don’t need to make a addiction of overdue payments because you’ll incur a price and also you’ll placed your account susceptible to default.

Important Pricing: The APR is between 11.Sixty five and 21.65 percentage. The annual charge is $35. There are no overseas transaction expenses.

Indigo Platinum

Courtesy of Indigo Platinum

With the Indigo Platinum MasterCard, you may get pre-certified right on their website to decide the probability which you’ll be authorized. Pre-qualification doesn’t affect your credit score score, and also you’ll get a decision in 60 seconds. A previous financial ruin received’t be held in opposition to you, relying on your different qualifications.

This is a ordinary credit score card – no safety deposit required. If you’re accepted, you’ll receive a $300 credit limit and the option to add a custom credit score card design.

The only downside is that you won’t realize your annual charge until you’re surely accredited. There’s a possibility of no annual price, a $fifty nine annual fee or a $75 fee within the first year. If you’re authorized for the $75 annual price, the fee will growth to $ninety nine in the 2d year and each yr after. That way up to 33 percentage of your credit score limit will go towards the once a year fee.

keyword tag

bad credit credit cards guaranteed approval

credit for bad credit

apply for credit card

no credit check credit card

s ecured credit card

apply for platinum credit card

credit card with bad credit history

credit card offers

No comments:

Post a Comment